Personal Loans starting at 10.25%

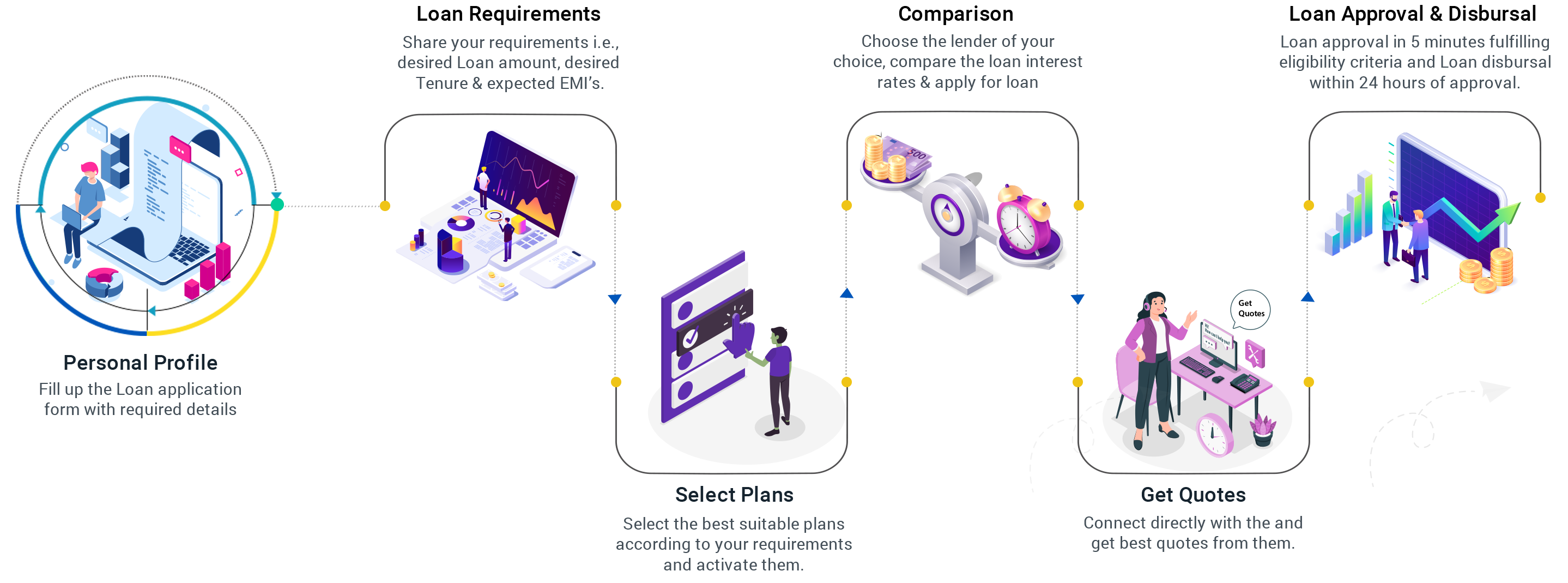

Apply for quick Short Term Personal Loans at low interest rates and get instant approval.

What is a Personal Loan?

Personal loans are considered as one of the easiest ways to borrow money from the lenders where a lender is not much bothered about a borrower’s warranty or guarantee to give loans. Due to this the Personal Loans comes up with a smaller tenure of starting from a Year to a range of 5 years approximately. People usually calls it an unsecured loan as well due to all these features and the eligibility criteria for Personal loan from lenders are also east and quick, so a consumer can get the loan quickly and in short span of time with minimum documentations. Due to all these the Interest rates and EMI amounts are usually higher as compare to other secured loan like a home loan or car loan. A personal loan can be used to meet any expense, such as emergency expenses, higher education, travel, wedding, etc

Diamond Membership is a tailormade solution for all the borrowers who require extra money to meet their daily routine needs. Diamond members can reach to the top lenders working with us directly avoiding the long waiting to discuss the best rates, quickly approvals and easy disbursals.