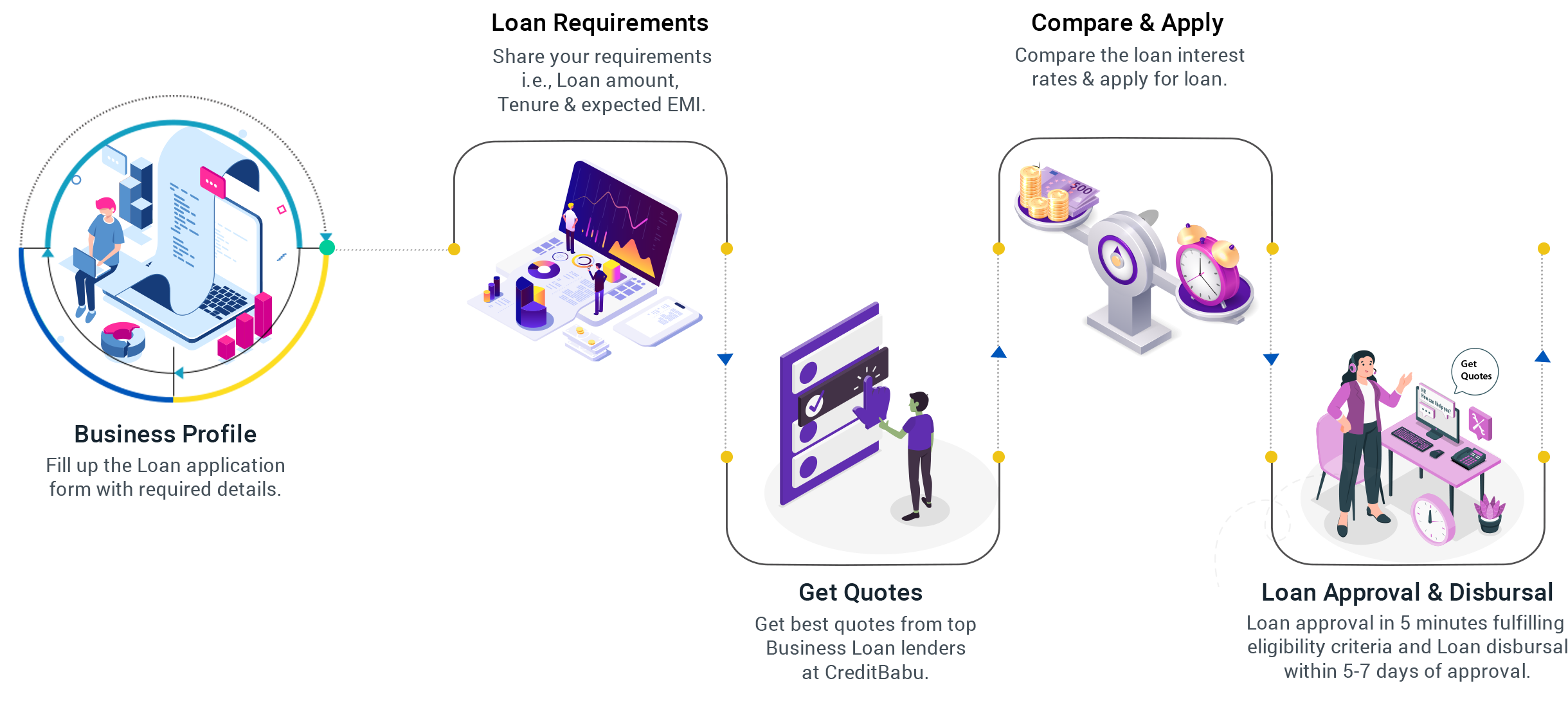

Business Loans starting at 10.25%

Apply for quick Unsecured Business Loans at low interest rates and get instant approval.

What is a Business Loan?

Business loan is a type of money which an individual or a self-employed person required to start their own business as well to grow their existing business or organization structure. Business loans are available from Rs.3lkh to Rs.5 crore based on individual business eligibility criteria and one’s own requirement of amount. At CreditBabu, we help startups to get secured as well as unsecured business loans with best possible discounts and with minimum documentation.

Platinum Membership is specially designed for Business owners who are looking for Extra money to scale their business or to expand the current business. We help all the startups who have unique ideas but struggling with money to run operations or to hire talent or to buy machineries and for any other business scale needs which are stuck due to low money. Platinum members can avail this facility and have a good amount of Loan basis on their ongoing business with affordable interest rates and quick approvals.