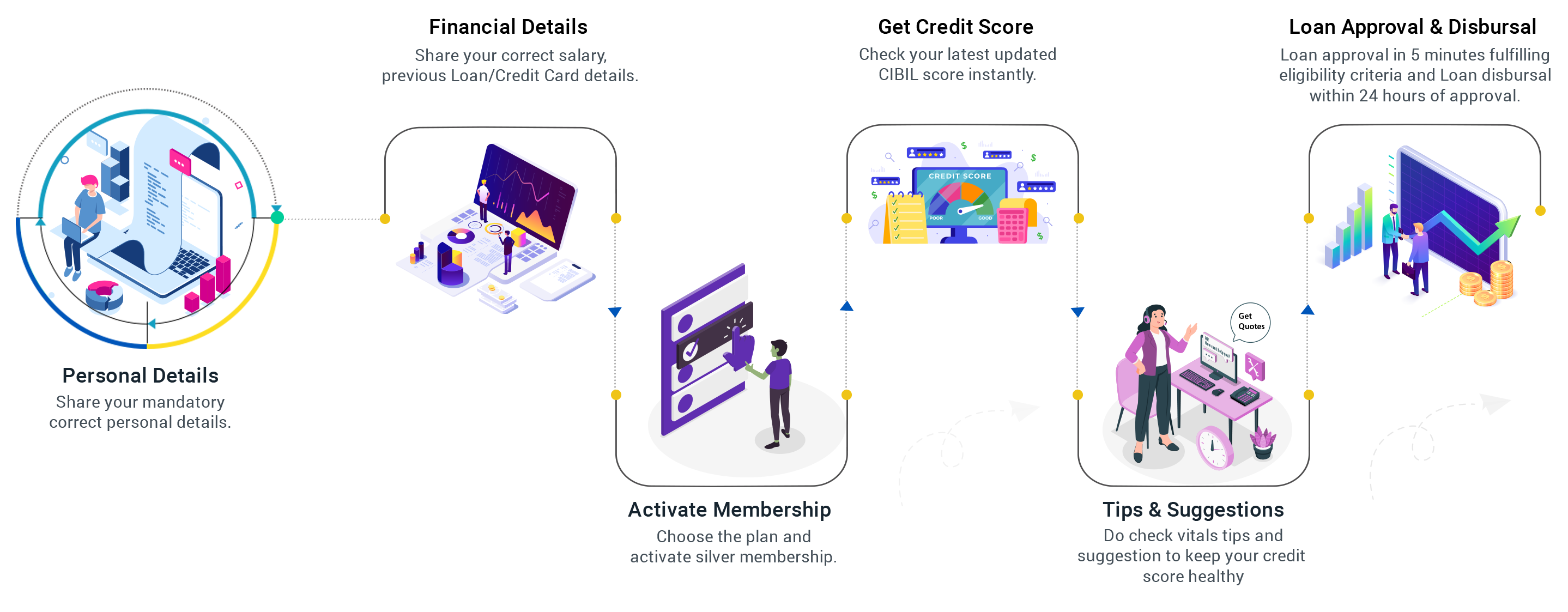

Your updated Credit Report is a Click Away!

What is CIBIL Score?

CIBIL Score or Credit score is your three-digit financial number starting from 300 till 900 which is considered as a financial wealth score which is derived from taking your credit history in consideration.

Silver Membership is one of the essential tools for everyone who want to access their financial profile as CIBIL Score is the utmost mandatory thing for anything be it Credit Card approval or for Personal Loan, Car Loan. Business Loan or any other borrow requirements. Silver members can quickly check the most updated Credit Score at CredChampion with super ease.