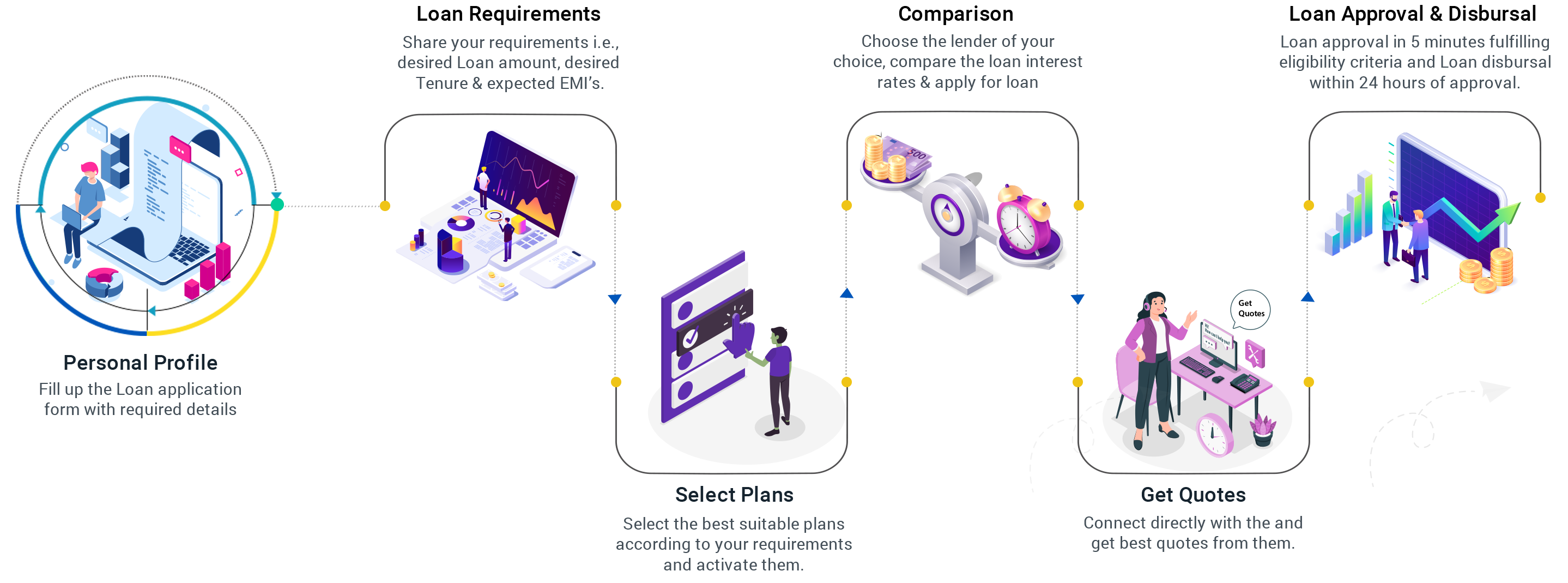

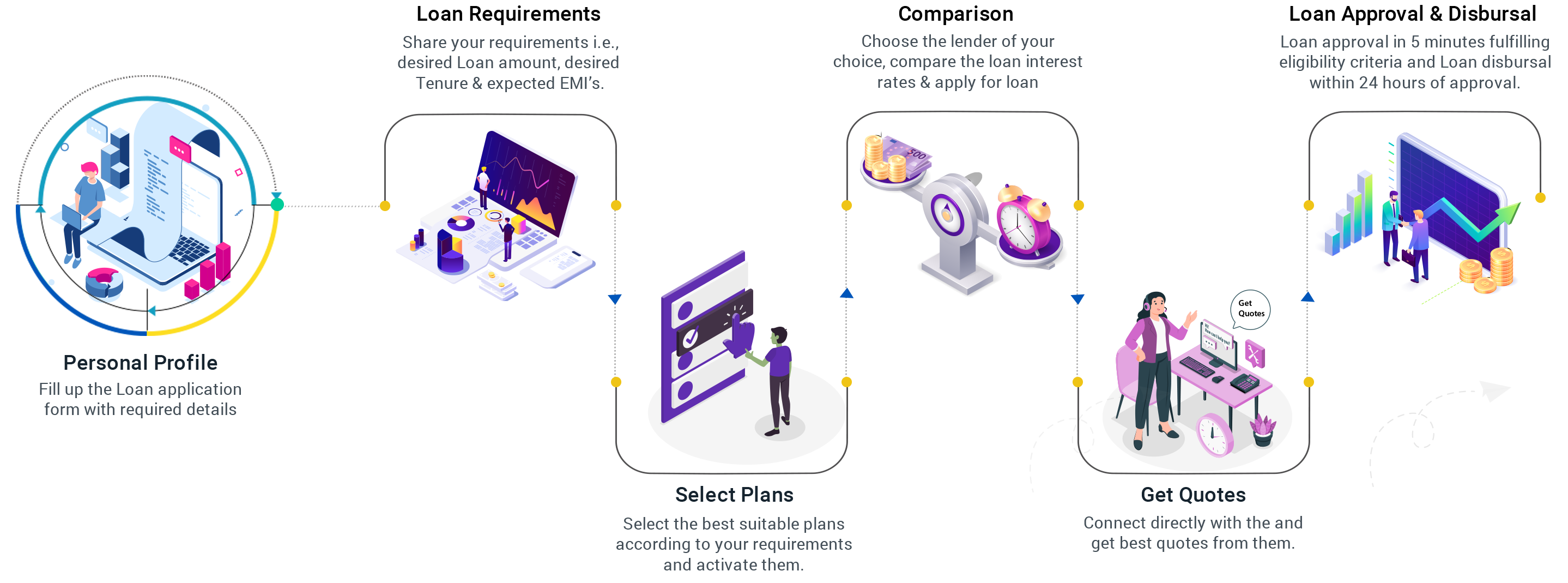

How Does The Process at CredChampion Works?

The process for Loan application is with CredChampion is quick and easy. We have different membership plans for customers basis on individual requirements. Select the best suitable plan and proceed with them. You can select any membership basis on your requirements which can be divided into two categories like based on your financial needs and other is basis on the tenure, the duration which you want to keep the loan with you.

Silver Membership is our initial plan and the most required tool to check your financial health. Access your updated CIBIL Score with us in a single click.

Our Gold Membership is designed especially for the customers who are not in requirement of big amount and they need some short money to fulfill their short-term needs.

Dimond Membership are there for the people who have decent job profile and earning good but they still need money for their personal needs. Gold members can avail personal

Platinum Membership is dedicatedly for the Business Owners and Self-Employed who need money to expand their businesses and they can avail Business Loans up to Rs.50 Lkh

CredChampion is an online platform that provides a Personal Loan, Insurance (Life & Health) alongwith & Credit Score check services to customers who are in need of best Lenders who provide Personal Loans and Insurances in the market with minimum documentations in shorter duration of time and with lowest Interest Rates with maximum benefits. We are a bridge between borrowers and lenders to know each other and to build a better understanding about customer profile and lender products and offerings.

CredChampion will not charge any payments or anything from you on our website, it is our partners who finally give you the loan or insurance is going to charge. We advice our customers to double check the details like premium, coverage, interest rates etc before making the payments.

To make the services and offerings more reasonable and affordable to our valuable customers we may receive fees / commissions from our lender partners.

CredChampion is a registered property of SNAl Digital Media. We have collected some of the information displayed on our website from publicly available platforms. CredChampion shall not be in any manner whatsoever, be held responsible for any reliance on the same.

CredChampion was built with a sole purpose to help our customers to know about their financial credit health, access them on timely basis, apply for different financial needs like Personal Loan or Business Loans. We work with leading CIBILI Score report providers like CIBIL, Equifax to give them the real time status of Credit Score which is accepted from majority of the Banks & Private lenders in the market. We act as a one-stop financial shop for all your credit needs and we make it easy for our borrowers to access our user friendly and easy web tools. We suggest our users to keep Credit Score healthy to avoid any rejections on their loan applications.

CredChampion is one of India’s fastest growing digital Loan service provider where a user can do Credit Analysis and check updated Credit Score Online.

When it comes to banking system, one should be very proactive and cautious and while selecting loans it is very vital to know the processes, documentations, dos and don’ts and that is where CredChampion comes in picture to help all the customers to make the personal loan journey is easy, comfortable and hassle-free. Why you can bang on us.

We work with Top lenders in the market who are rated A+ by fellow customers.

Approval rate is something which does matter for us and our customers.

We hate long documentation and long waiting with so many to-and-fro communications.

We aim for the lowest documentation & loan processing charges to give maximum

We support digital India where we follow one time registration and job done.